What is a Payment Gateway and How Does it Work?

Payment gateways help facilitate the eCommerce transaction that occurs between a merchant's website and the credit card of the customer placing the order. They are the technology that takes the customer's payment data, validates that data securely, checks that funds are available, withdrawals those funds and then lets both the merchant and the customer know the payment has been accepted. The merchant will then receive those funds minus any charges from the payment gateway based upon the T&Cs of the payment gateway.

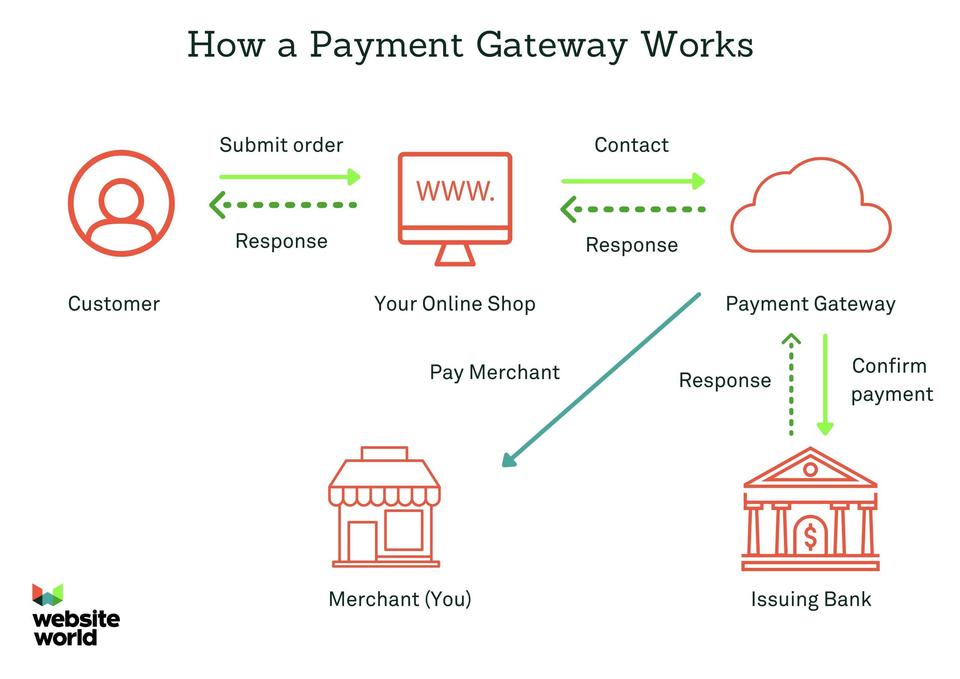

Or, in simpler terms, the payment gateway is the middleman between the merchant and the customer. It is responsible for the secure and prompt completion of the transaction on behalf of the merchant and letting all parties know if the transaction was approved or not. It is also the one responsible for encrypting the customer's data and keeping it safe, with the merchant having no part in seeing or storing of this data.

The benefits of having a payment gateway are that the customer's payment data is encrypted and safe, fraud is reduced and the merchant is protected against someone using a closed account, exceeding their credit limits, not having enough funds or using an expired card.

A payment gateway typically follows the same sequence as in the diagram above, though this all depends upon what the issuing bank says when the payment gateway presents the customer's credit card data to it. Here's more detail on how the payment gateway works:

- Your customer puts an item into their shopping cart on your website.

- The customer goes to the checkout, enters their credit card details and submits the order via your website.

- The payment gateway takes over and who encrypts the credit card and other details securely.

- The payment gateway takes this information and contacts the bank from which the customer's credit card came from.

- The customer's bank then checks these details and lets the payment gateway know if the payment should be approved or declined.

- The payment gateway then tells your website what the customer's bank said.

- Your website then tells the customer if their purchase has been approved or not.

- The payment gateway organises the collection of the money and then the payment of it to you the merchant at the agreed schedule.

Do You Need a Payment Gateway?

Your online store will by default come with a cart and a checkout. The payment gateway is completely separate from both of these. If you want customers to be able to pay using a credit card, then yes you will need one. But first, you will need to choose your payment gateway and then create an account with it.

However a payment gateway isn't required if you want your customers to pay in other ways, such as internet banking or in person.

There is a wide variety of payment gateways available which integrate with Website World. Each have their own features, charges and the sales volume that is best suited. Rather than recommend any, we suggest you explore the options available, ask other business owners for their recommendations and contact the payment gateway directly to learn more about their offerings.

Posted: Friday 17 December 2021